taxes to go up in 2021

How King Countys revenue. For tax year 2021 participants with family coverage the floor for the annual deductible is 4800 up from 4750 in 2020.

Tax Planning In 2021 Avoiding Potential Tax Storms

The difference is due to inflation during the 12-month period.

. Overall countywide property tax collections for the 2021 tax year are 66 billion an increase of 256 million from the previous year of 63 billion. IR-2022-175 October 7 2022 WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday. To help Canadians in the future the Canada Revenue Agency is taking out increasing CPP premiums from 2019 to 2023.

You cant run a 10 to 15 deficit forever he said. The state expects 95 of the payments to go out this year. For example if you are a single taxpayer who makes 41000 per year you were in the 22 percent tax bracket for 2021.

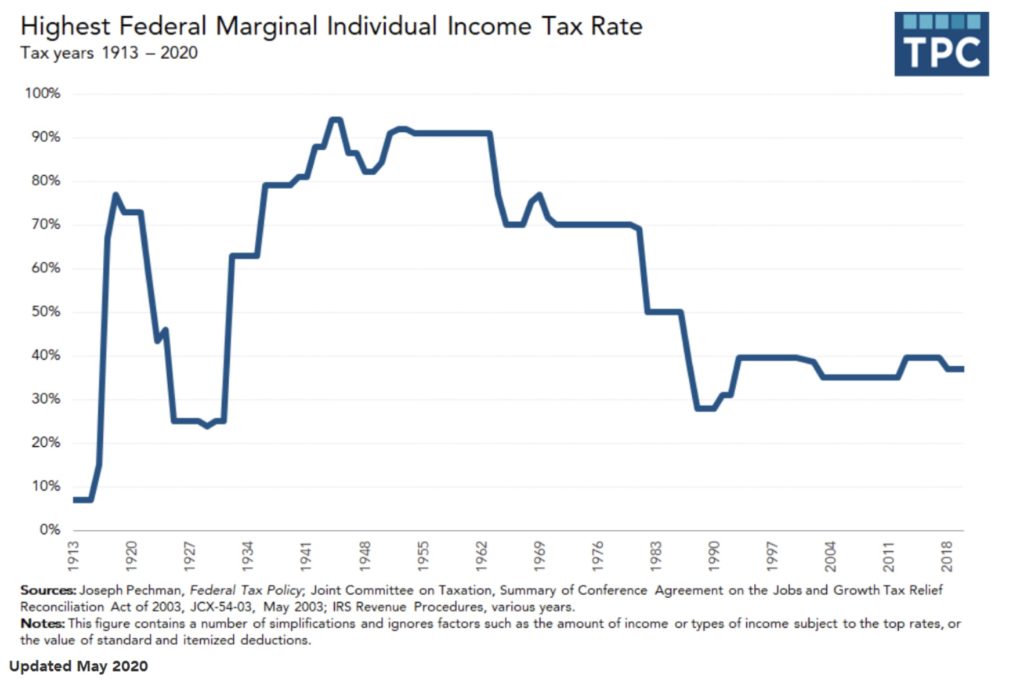

The seven federal tax brackets for tax year 2021. Raising the corporate rate to 25 percent would raise about 5221 billion between 2022 and 2031 on a. Biden has said that he would raise taxes for the top income bracket to nearly 40 percent from 37 percent and increase the corporate tax rate to 28 percent from 21 percent.

State and local taxes up to 10000 for married filers 5000 for single filers for a combination of property taxes. For tax year 2021 the CARES Act allows taxpayers to deduct up to 100 of their adjusted gross income AGI for charitable contributions up from the standard 60 of AGI in. However the deductible cannot be more than.

20 with AGI up to 22000 10 with AGI up to 34000 38 Frequently Asked Questions What were the 2021 tax brackets. Although the tax rates didnt change the income tax brackets for 2022 are slightly wider than for 2021. Each annual increase is small but it adds up to a.

Were going to have to pay for it. Then only the last 10550 the amount over 89450. Filers can also earn 100 per dependent they claimed on their 2021 taxes up to three dependents.

He also told the Wall Street Journal the obvious thing. The car shortage has caused a domino effect finally falling on Virginians tax bills. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Will taxes go up in 2022. In all a family of. Tax Foundation General Equilibrium Model January 2021.

For children under 6 the amount jumped to 3600. The used car shortage will make some Virginians personal property taxes go up. The standard deduction for 2021 increased to 12550 for single filers and 25100 for married couples filing jointly.

However for 2022 if you make the same salary your. Taxes are going to have to go up. Income tax brackets increased in 2021 to account for.

2 days agoThe next 67450 of income the amount from 22000 to 89450 is taxed at the 12 rate for an additional tax of 8094. The Joint Committee on Taxation released a chart indicating that federal taxes for those making between 10000 and 30000 would actually go up starting in 2021. Here is a look at what the brackets and tax rates are for.

Summary Of The Latest Federal Income Tax Data Tax Foundation

Opinion Make Tax Dodging Companies Pay For Biden S Infrastructure Plan The New York Times

When Is The Deadline For Filing 2021 Taxes Wltx Com

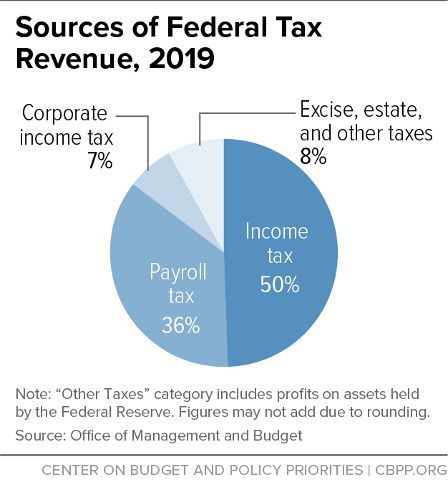

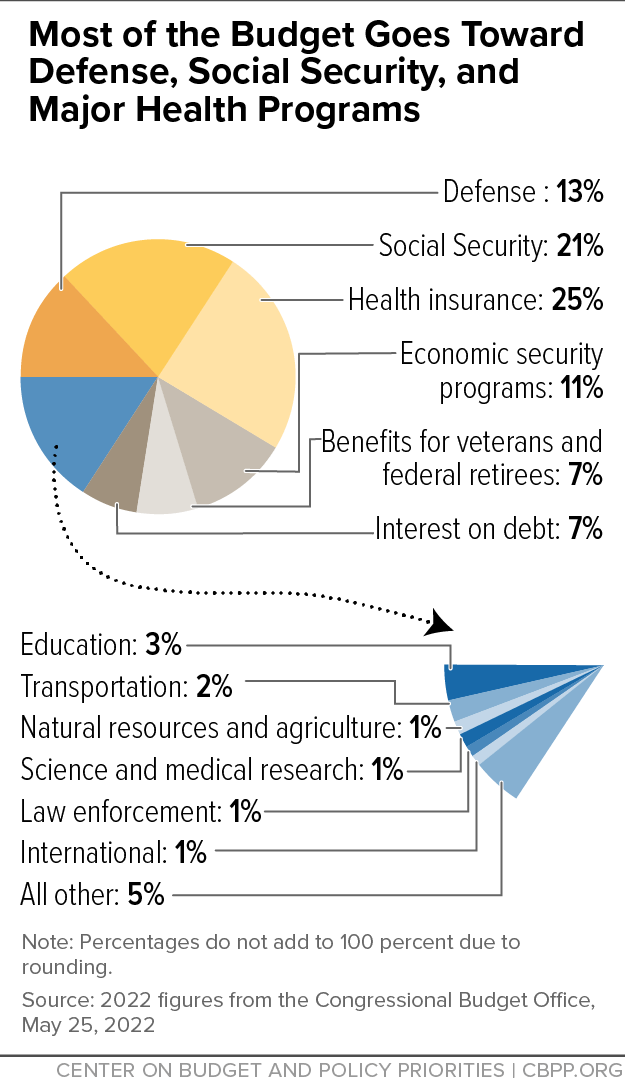

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Can You File An Extension For Your 2021 Taxes Wcnc Com

With Taxes Going Up Cannabis Operators Threaten California Weed Party

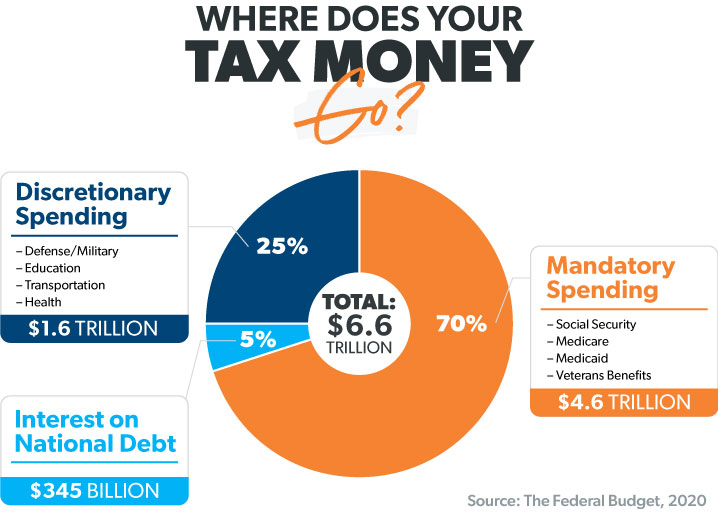

What Do Your Taxes Pay For Ramsey

Watch For Your New 2021 Tax Assessment Pierce Prairie Post

Why Your Portland Property Taxes Climbed This Much You Voted For It Oregonlive Com

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Tax Day 2021 Covid 19 Stimulus Effects On California Taxes Los Angeles Times

2022 Tax Guide How To File Your 2021 Taxes

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

Average 2021 Tax Refund Up From Past 3 Years Fox Business

Financial Planning Archives Adventure Wealth Advisors

Last Minute Tax Saving Tips To Wrap Up 2021 And Prepare For 2022 Gobankingrates